Relevant change and speed can only be achieved through investing and partnering with fintech and insurtech players. That’s why we asked Marco Keim, responsible for Aegon Continental Europe and member of the Management Board of Aegon, to share his thoughts. In our view he is one of the boardroom executives who not only advocate change but really support and push innovation first-hand. According to Marco, to drive innovation, we should leverage the blurring boundaries. And we should pack our bags and move to Asia.

Aegon is a global financial services company and currently present in 20 countries. Their US unit is the largest, after that comes The Netherlands. The company serves over 29 million customers worldwide and generate over €800 billion revenue generating investment. Over 26,000 employees worldwide help Aegon achieve its purpose of ‘helping people achieve a lifetime of financial security’.

You actually attended the first DIA edition in Barcelona, three years ago. It’s a pleasure to meet again!

Marco: “It’s incredible how your events have evolved. Big complements for taking the initiative and being the first!”

Let us start by talking a bit about Aegon. Aegon’s purpose is to help people achieve a lifetime of financial security. Can you tell a bit more about that?

Marco: “We re-thought our purpose after the financial crisis, more than 10 years ago. We asked ourselves: ‘As an insurance industry, what would add value to customers?’ It’s not just about building better products than competitors or whatever. We realized that even though we have a lot of financial knowledge to share, most customers are not interested in financial matters. 90% of customers in Western Europe, but probably also in Asia and other parts of the world, are not busy thinking about their financial situation. They spend more time buying a new pair of jeans than on thinking how to improve their financial situation with financial products.”

What do you do to bridge that gap?

Marco: “We decided to use our knowledge to help customers make better decisions themselves. In our view that is our reason for being. As a result of retreating governments and corporations, more and more of our customers are responsible themselves for their retirement. Most of them don’t even realize that. Here in the Netherlands, most Dutch believe they will get 70% of their final wage as a pension. Which is really not the case. This is the gap we need to address.”

So, you see that the need for these services is bigger than ever. But we also notice that in certain markets, sometimes even the same markets where the latent need is getting bigger, actual demand is declining. How do you get to the customer in the right way?

Marco: “It’s about digital and data. This for us is the future, the Digital Insurance Agenda. With all due respect, if you’re not digital in these days … It’s as basic as plumbing. And data is where we can add much more value. To use our data, which we already have as an industry, and combine it with external data, we can be much more relevant for customers – at the right moment with the right information, that is the nut that needs to be cracked. And a growing number of initiatives, like PSD2 in the banking area, enable us to have more access to data.”

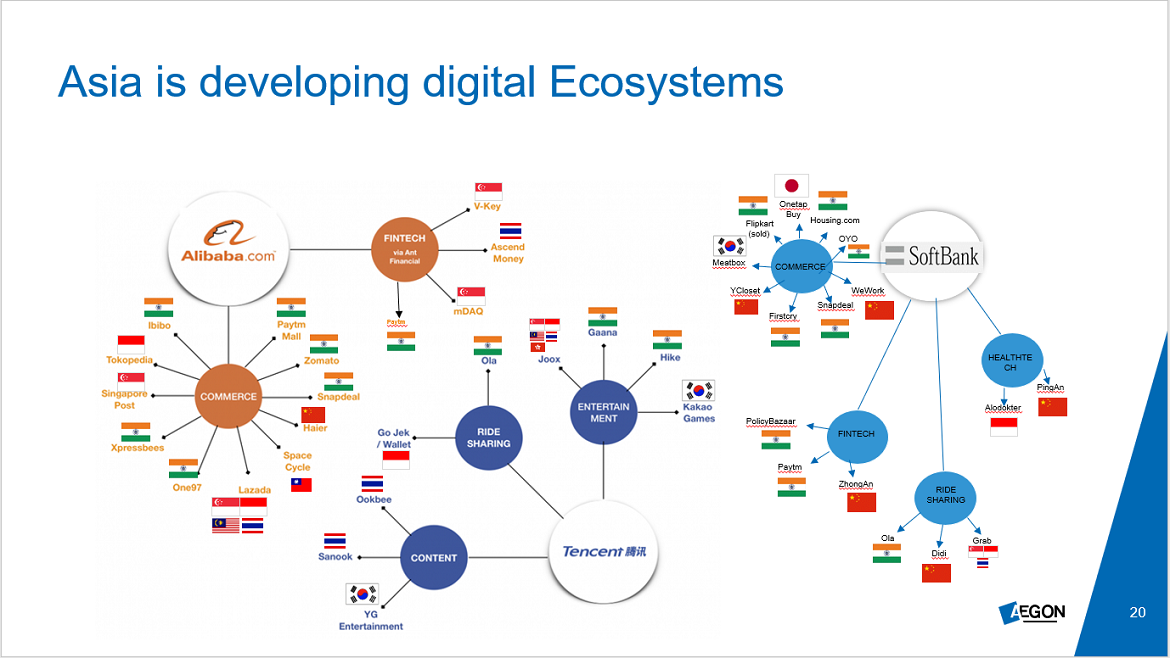

In Asia you already see digital platforms joining with insurers to share data for better underwriting and better targeting.

Marco: “Next to data and digital you need an insurance product, but you need more than just that. Recently, I did a presentation for the insurance practice leaders of a global consulting firm. I told them that, if they would stick to insurance, they probably would face problems going forward. Because I believe you should not look at the opportunities strictly from an insurance point of view. Boundaries are blurring. Our business is much more than insurance. We are in financial services, but a customer doesn’t mind whether the solution comes from an asset manager, a bank or an insurer. We need to broaden insurance to financial services.”

Could you give an example?

Marco: “Well, if you take our company in the Netherlands, our new business hardly comes from insurance. It is mortgages; we are a third party administrator

for pension providers. So, what formerly was an insurer, now is a completely different company. That’s also reflected in our balance sheet: 316 billion assets under management. You may think we are more of an asset manager than an insurer.”

So, a key takeaway is that the future is about blurring boundaries. Then the obvious question would be, how do you manage this change?

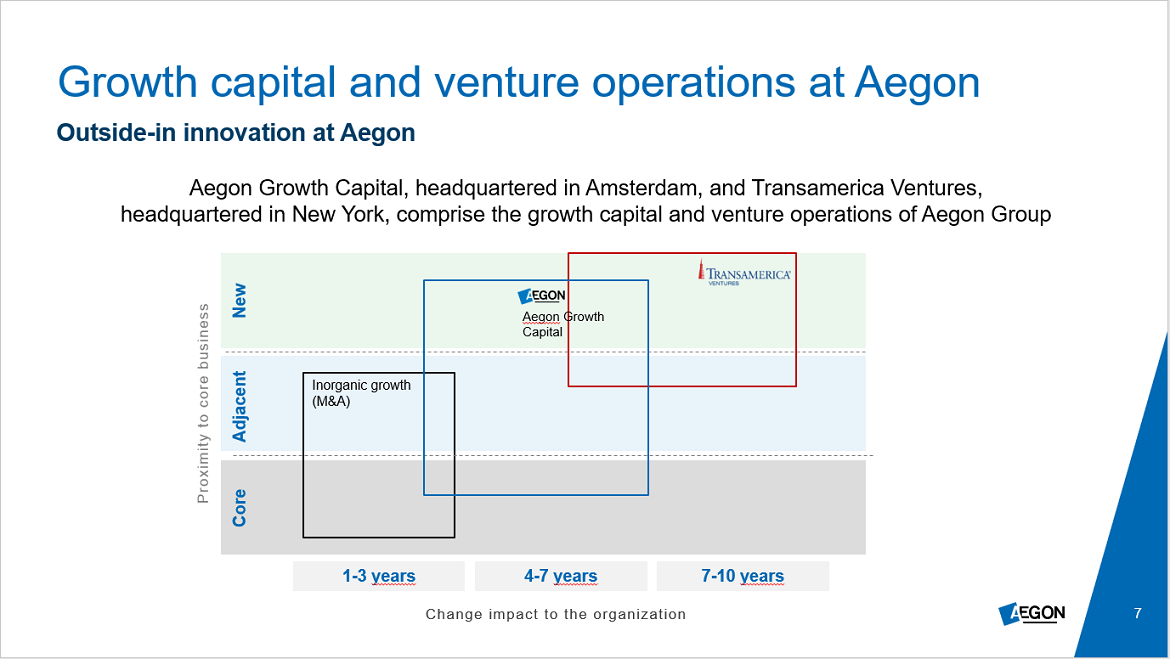

Marco: “At Aegon we use the, what we’ve coined, ‘core – satellite – universe’ approach. About 10 years ago, when I started with innovation, we first started in-house. We had some ideas, we wanted to create a new digital in-house bank but it didn’t work out as we hoped for. Because in-house innovation is very difficult, almost impossible.”

Most incumbents are not the best inventors in the world …

Most incumbents are not the best inventors in the world …

Marco: “Indeed! So, we decided to do this differently. We realized that within our own environment the existing organisation is less open to everything that is new. That’s why we decided to create companies separate from the existing organisation that were still 100% owned. One of these companies was Knab, a digital bank, which was set up at a different location and in a fully remote fashion with no interference from existing business. It focuses on individuals and the self-employed and it is quite successful. It is the only profitable digital bank in Europe and it has the highest NPS.

But we actually made a very interesting mistake. We thought we wanted to disrupt the banks by offering more transparency, not hiding the hidden costs. So we decided to charge more than regular banks. Instead of €5 a month, we’d charge €15 a month but without hidden costs other banks charged, well in excess of the €15 a month. It turned out to be a disaster! The Dutch press opened with the line: “Knab, the most expensive bank of the Netherlands”. We decided to pivot, go back to the €5 and now I dare to say it is quite a successful bank: its rapidly growing customer base shows that it is a very attractive proposition for the self-employed, which is a growing market segment across the world.”

Speaking of blurring boundaries, you have an interesting partnership with BCD Travel, with whom you launched GoBear in Asia. Can you tell a bit more about that?

Marco: “A lot of corporates invite us to do something together. That’s what happened with BCD, which is a worldwide travel agency with a lot of experience in Asia. Initially, we discussed selling travel insurance. Long story short, that’s how GoBear got started. Conceptually it was more or less a copy of Skyscanner, but it is pivoting more to a financial supermarket than to an aggregator. It is now operating in 7 Asian countries. Data is the key here. We own 50%.”

Based on your experience, should you always own 100% of a startup when you have the opportunity?

Marco: “My answer is clearly no. Having a 50% private equity partner disciplined us.”

At DIA we see insurtechs operating in different business lines using the latest technologies. How do you, as an incumbent, make sure to have access to this cutting-edge knowledge?

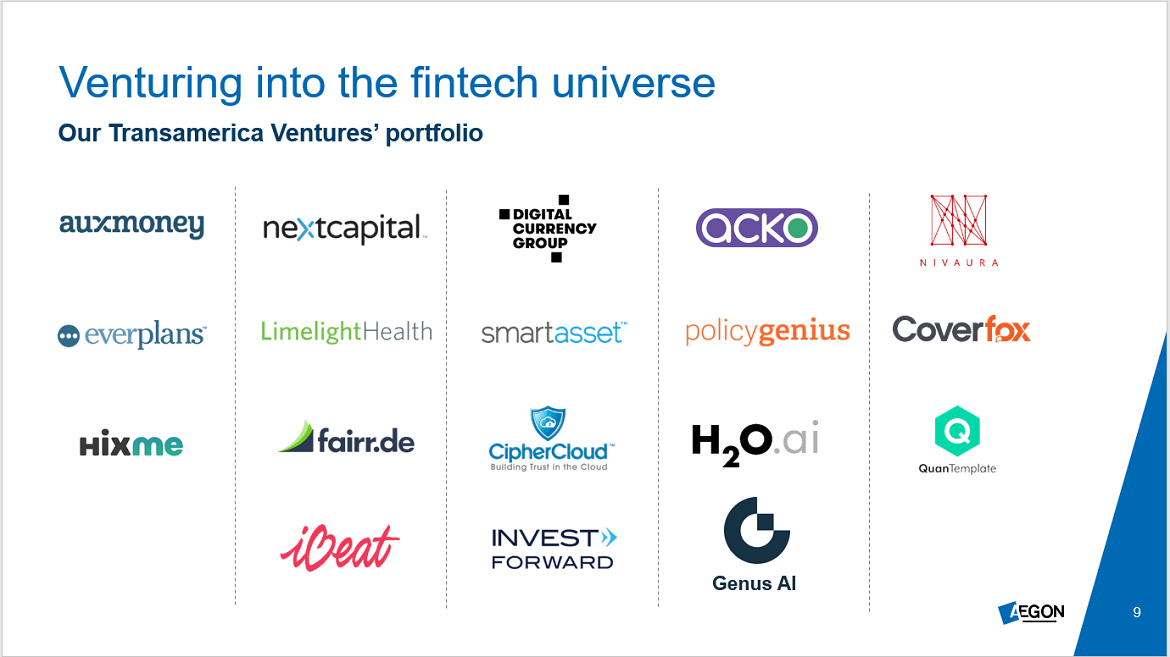

Marco: “We realized we could never have access to that ourselves. That’s why we started Transamerica Ventures as one of the first Corporate InsurTech VC’s in the industry. Here, we are looking for these cutting-edge companies, series A startups, who have certain very specific, extraordinary and technology driven knowledge. We always look for a link with an Aegon entity so that we combine knowledge from outside with that of our existing businesses. We want to learn and make use of what is happening outside in the world, because we don’t have the skills to develop it ourselves.”

What about the companies selected, are you looking for specific solutions? Can you share a few names of the companies in the portfolio of Transamerica Ventures?

Marco: “Transamerica Ventures itself wants to have a return on the investments of course. So, our criteria is that, as Aegon, we should be able to make use of their solutions. Let me share some examples:

Everplans developed a digital solution for estate planning. Our agents use this to increase interaction with customers and improve cross-sell and deep sell. By the way, here we own less than 5%, as we don’t strive for major influence or to have board seats.

Nextcapital is a robo advisor that we use for expiring pension policies. In case you have a defined contribution scheme it supports in where to invest the money in. A very innovative solution which we integrated in our core systems.

H2O.ai is an AI company. Almost seven units in Aegon are using their technology to advance AI.

In all three cases we invested in the company but also helped them to get access to the corporate, to create use cases, and to benefit from all the knowledge and experience we have. And in return we get access to their technology.”

More incumbents these days are setting up venture funds. What are your thoughts about that?

Marco: “There are a few challenges to deal with. Take the cultural challenge. It is still very difficult to get our own people excited about ideas they didn’t invent themselves. But yes, it is true that more and more companies are creating such funds. So, if I would be a startup, I would really look at how sincere the funds is, what proof points they can show you, for instance on how to leverage their customer base. These days startups have a choice. It is Aegon’s ambition to be the best partner and the best investor in series A for startups. We show the proof points. But we also show the cases where for whatever reason it didn’t work out.”

Recently, you set up the Aegon Growth Capital www.aegongrowthcapital.com, a new fund investing in expansion and growth capital for fintech and insurtech companies. How did that come about?

Marco: “Apart from blurring boundaries, the unbundling of the value chain is also very important. Revenue pools are created outside our industry by companies now rapidly scaling up. For us it’s very clear what our role is, what we do and what we shouldn’t do. That’s why we created a separate fund. This fund is run by professionals and they manage it like a fund, and we, as a shareholder, are on a distance. So, if companies are doing business commercially with Aegon, the people they deal with are different from those who invest in their expansion and own the shares. Also, by using the fund we don’t finance these investments from a budget. This avoids short term discussions because at some point the investment could be perceived as an expense. We separate the shareholders’ discussions from the incumbent businesses to avoid interference. Gijs Jeuken, CEO of Aegon Growth, headed a company financed by a private equity firm himself, which after a steep growth path was acquired by Aegon. He knows first-hand the benefits of having access to growth equity, and the other side of the story.”

That’s an interesting lesson; if the incumbents start to interfere, in essence the whole system dies …

Marco: “We asked ourselves: ‘What is the future?’. Our strong belief is, that our type of companies are not able to reinvent themselves. You can put a lot of money in innovation labs and hiring people, but innovation is already happening outside. So why not look and invest in those companies which potentially, not per se, might be the future of our company. We learned a lot in the process. For instance – and this may sound a bit cynical, but it is the truth – if you own 50% or more, we run the risk to kill the company. We learned this the hard way. So, our Growth Fund rather has a stake of, let’s say 20-40%, and has private equity in it as well for financial discipline. Then, hopefully, we reach a point of time to get a bigger stake if the company is already sufficiently strong, and at least have made a good investment decision by backing the right entrepreneurs.”

So, you invest into companies you really believe in, and that will potentially be the future of Aegon. How does this work in practice?

Marco: “We focus on four segments. We strongly believe that the value chain in the financial industry will be completely disrupted. Only if you’re extremely strong in every part of the value chain you will survive. Most of us are not strong in every part of the value chain, so we have to outsource it. Don’t try to own everything. Then the question is: “Which part of the value chain is the most interesting part?” We believe those which are closest to the customer potentially create the biggest value. That’s why two of the focus areas of the Growth Fund are digital /omni-channel distribution and customer engagement, content marketing & platforms. Furthermore, we focus on business process optimisation and automation to decide on the new way of getting to customers in an efficient way, making use of digital and data, and still have the right products for the customer. Then we have asset & wealth management because in a world where governments are retreating, it’s very clear that customers have to do more themselves.”

One of the main overarching themes of the 2019 DIA conferences is ‘East meets West’, because we believe there is so much we can learn from one another. What is your view on the developments in happening in Asia?

Marco: “I have the privilege to travel to Asia about 10 times a year. Every time again it is a mind bubbling experience and I’m flabbergasted when I come back. That’s where I get most my energy from! The speed of change in Asia . . . Here in Europe and America, we are somewhat behind the curve compared to what’s happening over there! We must be careful not to become sitting ducks. Granted, Asian players can benefit from the big numbers, more (young) people, they don’t have GDPR – and I can find many more excuses. But the real differentiator is that they are much more entrepreneurial. They just try and do and act. They leapfrog and that is what really resonated with me. Also when it comes to blurring boundaries. You see that all over the place in Asia. You see the big Asian tech firms expanding, really building huge ecosystems. A nice example is Go-Jek, the ‘motor Uber’ of Indonesia. But when you look at their offering … they have everything, from insurance to banking and you can even book a massage via their Go-Life app! We see more and more incumbents like ourselves teaming up with them. We are doing the same in India. Because this is the future. When you say that we learn a lot from Asia, I can only confirm.”

Any closing words for the DIA Community?

Marco: “Let me end with three takeaways: First, interact as much as possible with start-ups, and enjoy. The DIA conferences are the perfect place for this. Secondly, don’t look at our challenges only from an insurance perspective, watch the blurring boundaries. We are in financial services. A customer doesn’t know who has a license, they want a solution for their problem. Finally, pack your bags! Move to Asia and try to learn!”